child tax credit october 15

For example in the United States only families making less than 400000 per year may claim the full CTCSimilarly in the United Kingdom the tax. A child tax credit CTC is a tax credit for parents with dependent children given by various countries.

Child Tax Credit 2021 8 Things You Need To Know District Capital

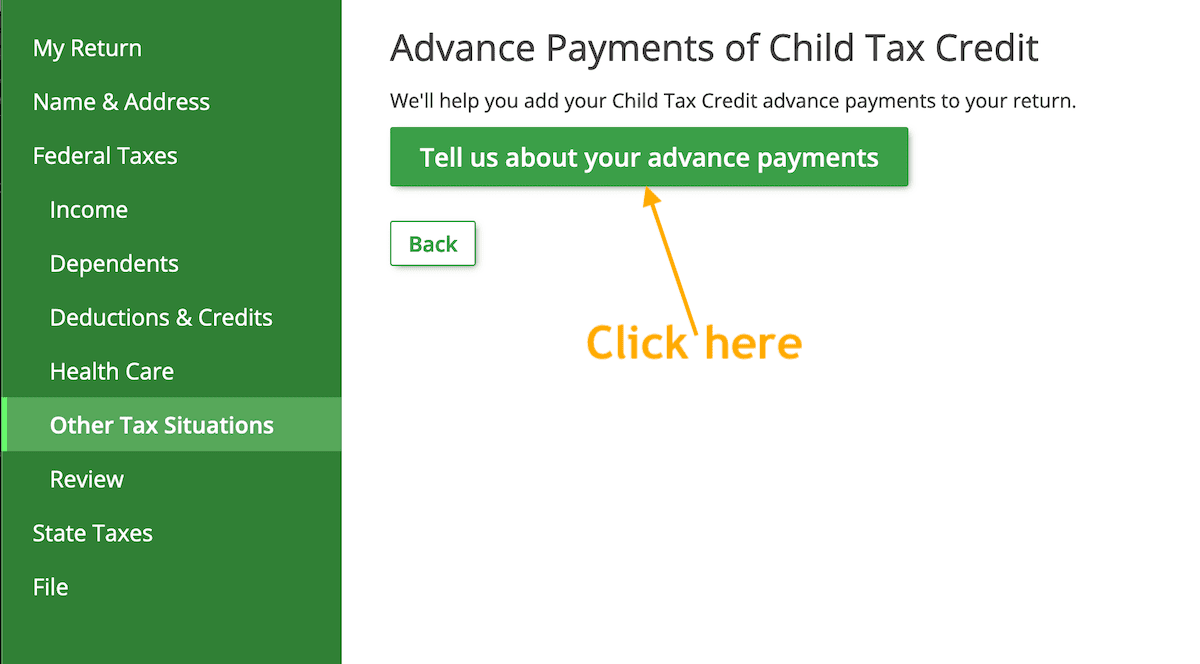

Disbursement of advance Child Tax Credit payments began in July and continued on a monthly basis through December 2021 generally based on the information contained in your 2019 or 2020 federal income tax return.

. Estimates based on deductible business expenses calculated at the self-employment tax income rate 153 for tax year 2020. For Tax Year 2021 the credit can be worth up to 3600 per child in 2017 and earlier tax years the. Additional information about the IRS portal allowing you to follow update or even opt-out of the new payments will also be provided.

The refundable portion of the credit increases from 1000 to 1400 and the earned income threshold for claiming the refundable credit is lowered from 3000 to 2500. Earned Income Tax Credit EIC Child tax credits. There is not another Advanced Child Tax Credit payment coming.

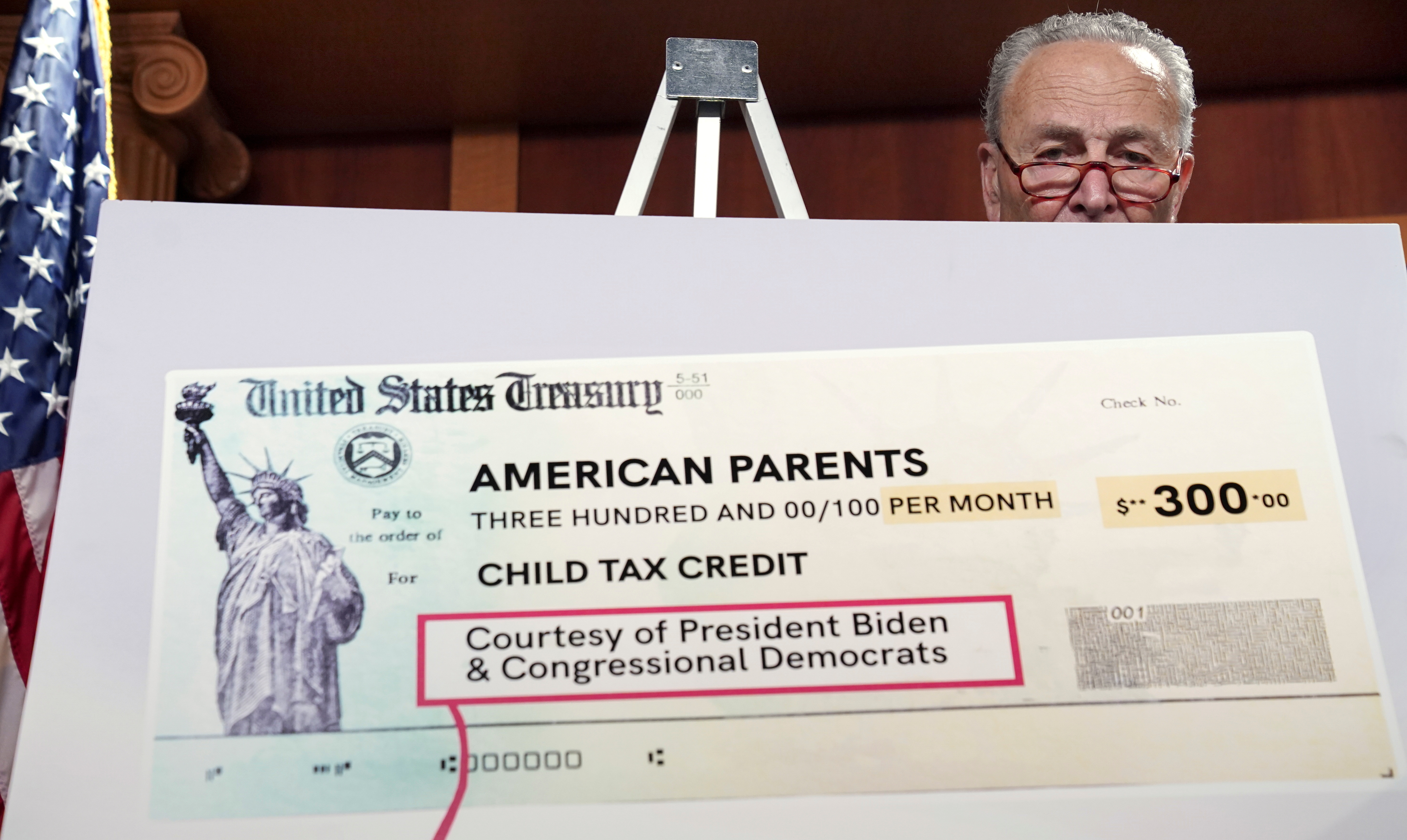

The American Rescue Act of 2021 temporarily increases the Child Tax Credit up to 3600 per child under age six and up to 3000 per child under age 18. The credit is often linked to the number of dependent children a taxpayer has and sometimes the taxpayers income level. The IRS has not announced a separate phone number for child tax credit questions but the main number for tax-related questions is 800-829-1040.

Even if you had 0 in income you could have received advance Child Tax Credit payments if you were eligible. October November and December -- in the form of the Advanced Child Tax payments. Dont forget Tax Day is not April 15 2022.

Actual results will vary based on your tax situation. Child Tax Credit Increased. The Child Tax Credit is intended to help offset the tremendous costs of raising a child or children.

Instead of calling it may be faster to check the. The child tax credit was changed significantly in 2021 making it fully available for the first time to the lowest-income families including those who typically do not have to file a tax return. Frequently asked questions about the 2021 Child Tax Credit and Advance Child Tax Credit Payments Topic E.

The 2021 child tax credit was temporarily expanded from 2000 per child 16 years old and younger to 3600 for children age 5 and younger and to. Normally you would just get your Child Tax Credit when you filed your taxes and its different this year. The child tax credit is worth up to 3600 per child in 2021 and eligible filers can receive half their credit in advance through automatic monthly payments.

Student Loan Interest deduction. Families with 60 million children were sent the first monthly check for the Child Tax Credit on July 15That federal benefit is providing about 15 billion in. These updated FAQs were released to the public in Fact Sheet 2022-29PDF May 20 2022.

About 35 million US. This tax credit is changed. The federal Child Tax Credit is kicking off its first monthly cash payments on July 15 when the IRS will begin disbursing checks to eligible families with children ages 17 or younger.

The amount increased from a maximum of 2000 per child to 3000 for kids ages 6 to 17 and 3600 for children under the age of 5. Below the calculator find important information regarding the 2021 Child and Dependent Care Credit CDCCThis credit has been greatly changed as part of the third stimulus bill or American Rescue Plan Act. Learn what the changes are who qualifies payment amounts and when those payments will be issued.

August September October November and December your refund will most likely be. Updated for Tax Year 2021 October 16 2021 0804 AM. Paying for childcare and dependent care can be very expensive.

See Important Updates on the Advance Child Tax Credit Payment for Tax Year 2021. The Child Tax Credit and Working Tax Credit leaflet has been added for tax year 2018 to 2019. Fortunately there is a tax credit to help defray the costs.

If you had to pay someone. Starting in 2018 the TCJA increases the maximum child tax credit from 1000 to 2000 per qualifying child. It is a now a fully refundable tax credit and you can qualify even if you had no earned income.

6 April 2018 Rates allowances and duties have been updated for the tax year 2018 to 2019. How did eligible individuals receive their advance Child Tax. The Child Tax Credit CTC for 2021 has some important changes stemming from the American Rescue Plan ARP.

The Child Tax Credit under the American Rescue Plan rose from 2000 to 3000 for every qualified child over the age of six and from 3600 to 3600 for each qualifying child under the age of six beginning in tax year 2021 the taxes you file in 2022.

2021 Us Tax Deadlines Expat Us Tax

Industrial Accounting Taxation Training Accounting Training Accounting Train

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

Let S Find Out Why October 2020 Is Important For Gst Compliance Task Task Compliance Indirect Tax

Child Tax Credit 2021 8 Things You Need To Know District Capital

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

Recovery Rebate Credit 2021 Tax Return

Child Tax Credit Will There Be Another Check In April 2022 Marca

Child Tax Credit 2021 Here S When The Fourth Check Will Deposit Cbs News

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

Child Tax Credit Could Spur 1 5 Million Parents To Leave The Workforce Study Says Cbs News

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

Tax Return Deadlines 2021 Tax Deadline Tax Return Deadline Tax Refund

Neil Henderson On Twitter Cyber Attack Art Of Persuasion Financial Times

Explainer What Are The Child Tax Credits Democrats Are Battling Over Reuters

The Historic Effect Of The Expiration Of The Production Tax Credit Wind Power Climate Change Solutions Power

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities